While the pandemic has led to prolonged disruptions across many sectors of the global economy, the real-estate sector has proven resilient. Despite the economic uncertainty and structural shifts in how people live and work, global commercial real estate sales volumes grew 59% YoY in 2021, surpassing the previous peak in 2019 by 22%. In the same vein, global real estate securities also saw significant growth in 2021.

Real Estate Investment Trusts (REITs) were trading up 29% for the year in December 2021, with strong performance across sectors. The FTSE EPRA Nareit Developed Index posted a 27.2% increase in returns. North America led this growth, while Europe and Asia lagged due to a resurgence of Covid-19 cases. There are 28 REITs in the S&P 500 index. In 2021, listed REITs raised $127 billion in public market offerings. In the US, REITs contributed to the creation of 2.9 million full-time jobs in 2020 and generated $197 billion in labour income.

Strong Macroeconomic Factors Pushing REIT Investments Forward

This growth has been due to many macro and fundamental factors, including monetary policies, strong vaccine distribution, reopening of economies and huge fiscal stimulus. With continued economic growth, a strong case for monetary tightening worldwide and limited new supply additions, REITs have further scope to grow going forward. According to Morgan Stanley, both cash flow and dividend growth will remain above 10% for 2022.

REITs Tend to Grow with Rising Economies and Interest Rates

Historically, REIT returns have shared a strong correlation with interest rates. While conventional wisdom says that real estate suffers from rising interest rates, history indicates that when GDP growth accompanies rising rates, it creates a favourable environment for real estate.

During periods of growth in the economy, REIT values increase as the value of the underlying real-estate assets increase. The increased demand for financing in a growing economy also results in increased interest rates. In a study by S&P, which analysed 6 periods from the 1970s onwards, where the 10-year Treasury yields grew significantly, REIT returns increased in 4 of them and outpaced the stock market for 3 of the periods.

REITs see a similar trend with rising inflation rates as well. This is because inflation is usually a product of strong economic growth, whereas real estate is considered an inflation hedge by investors. As prices increase, so do property values, benefitting cash flow streams.

Currently, the US is facing historic levels of inflation, which has prompted the US Fed to raise interest rates for the first time since 2018. On March 16, 2022, the US Fed raised its benchmark rate by 0.25 percentage points and hinted at plans for further rate hikes in the future. Research by Nareit shows that total returns of US REITs correlate with rising interest rates. REIT returns have been positive in 85% of the periods when Treasury yields have risen between Q1 1992 and Q4 2021.

However, it is important to note that not all REITs are created equal. They operate in several industries, including hospitality, healthcare, residential, retail, and more. Each of these sectors reacts in different ways to economic fundamentals. The debt profile of a REIT should also be considered when making an investment decision.

REITs are High Dividend Paying Investments

REITs are known to deliver higher returns, due to high, steady dividend growth and long-term capital appreciation. They are great portfolio diversifiers due to their low correlation with other assets. REITs can offer exposure to the global real estate markets too.

Their unique tax structure leads them to offer higher than average dividends. They pay zero corporate tax, and for that, they have to pay out 90% of their taxable income in the form of dividends. Equity REIT dividend yields stood at approximately 2.6% in 2021, which was twice the 1.2% yield of the S&P 500. As per forecasts by BCA Research, REIT dividends could rise by 10% on average in 2022, higher than the 7.1% for the S&P 500.

Thus, REITs can be a good option for income-seeking investors, as they offer higher yields than the fixed-income markets or even stocks. However, investors need to consider the taxation of this dividend income. Qualified REIT dividends could come under the TCJA (Tax Cuts and Jobs Act). The best course of action is to consult a financial advisor to understand tax obligations.

Top Dividend Paying REITs

Let’s look at some REITs that have seen fast dividend growth. These companies have been raising payouts for a couple of years and show trailing 12-month (TTM) dividend growth starting at 10%.

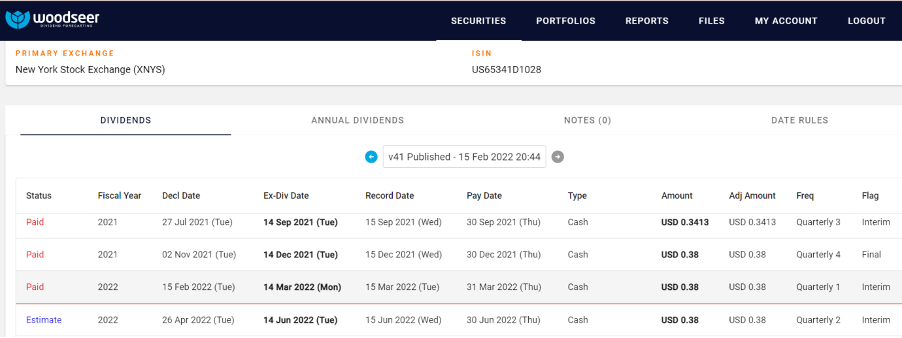

NexPoint Residential Trust

This REIT owns multi-family real estate in the Southeast and Southwest US, including areas like South Florida, Atlanta, Raleigh, Tampa, Las Vegas and Charlotte. The REIT has a dividend yield of 1.7% and TTM dividend growth of 10%. NexPoint creates value by upgrading acquired properties with modern and energy-saving amenities. With the migration of tech workers and retirees to the Sunbelt, this REIT has growth potential. It increased its dividend several times in 2021 and is expected to declare a dividend in April 2022 of $0.38, ex-div date June 14, 2022.

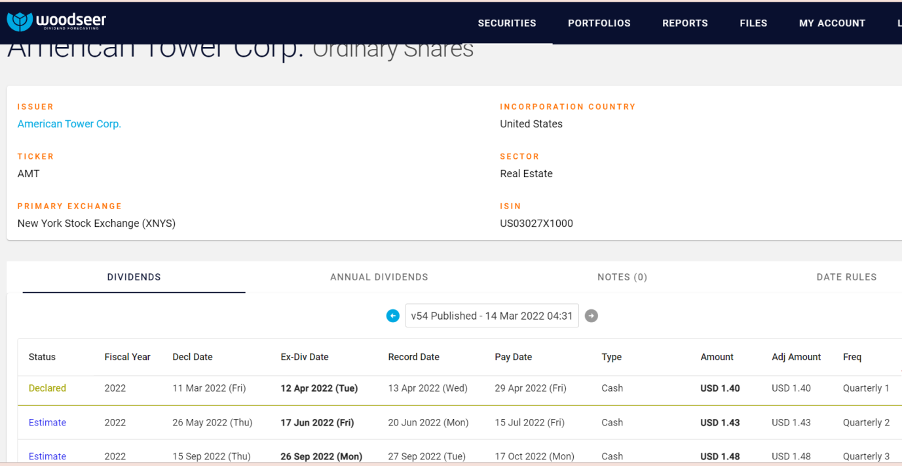

American Tower Corp.

The REIT has offered more than 20% annual dividend growth since 2011. It is the world leader in cell tower infrastructure, owning over 220K cell tower sites across continents. With the growing penetration and demand for wireless services and mobile devices, this REIT is only expected to grow. Its TTM dividend growth is 15%, with a dividend yield of 2.1%.

American Tower is expected to raise its dividend in May 2022, to $1.43, ex-div date June 17, 2022.

Predicting the Global Real Estate Market with Woodseer

Favourable economic growth conditions are good for real estate securities. However, the pandemic has accelerated many trends in consumer, employee and organisational behaviours. Brick and mortar retail is not expected to decline completely, as previously thought. There is a new appreciation for the storefront, with retailers seeing them as important for distribution, and in many cases, for brand development. Lastly, the world’s largest companies are stressing more on achieving sustainability and carbon neutrality. All these factors will reshape the real estate sector in the coming years.

With Woodseer Global’s AI+analyst approach, predicting REIT dividends is reliable and accurate for investors. Trusted by the world’s largest investment and hedge fund firms, Woodseer offers dividend forecast data for every industry. Contact us to learn more.

With special thanks to Cedar Cianciulli.