After Covid-19 hit banks hard in 2020, the global banking industry made a stellar comeback in 2021. The fiscal and monetary policy support for corporates and households clearly worked in their favour. After a brief hiatus, major banks are declaring dividends for shareholders of record globally. Germany’s leading bank, Deutsche Bank AG resumed dividend payouts after 3 years, in end-January 2022. The bank intends to return around €700 million ($790 million) to investors through buybacks and dividends.

Dividend growth is also expected in the Canadian banking sector, where the top 6 banks, including Bank of Nova Scotia (Scotiabank), Royal Bank of Canada and Bank of Montreal, are forecasted to raise dividends after a strong Q4 2021. On average, these 6 banks have a dividend yield of 3.3%, compared to the global average of 2.5%. A dividend payout hike is forecast between 10% and 34%. US-based Wells Fargo announced a dividend hike of 25% in January 2022. Earlier in 2021, the biggest US banks had announced plans to pay an extra $2 billion of dividends to investors in Q3 2021.

Capital distribution plans, in the form of dividends and share buybacks, are expected to continue in the sector in 2022, indicating stronger balance sheets. Let’s take a deeper look at the banking industry (and dividends) for 2022.

Banking Sector Outlook for 2022

The global banking sector stabilised in 2021, and the net rating outlook improved substantially. While strong fiscal support has been a major reason, the sector was already very prepared in 2020 to deal with headwinds. Since the 2008-09 global financial crisis, banks have been bolstering their capital, funding and liquidity buffers. Extensive investment in digitalisation continued, to better serve customers. All this has paid off. Overall, the banking sector withstood the pressures of 2020, while also increasing capital reserves.

Going forward in 2022, recovery in the banking sector is expected to continue in tandem with the global economic recovery. This means it will be an uneven recovery. While US- and Canada-based banks have done well, European banks have suffered from exposure to some of the hardest-hit sectors during the pandemic. They continue to face challenges, such as negative interest rates and fragmentation of the regulatory system. In contrast, the APAC region has performed well, with continued strengthening of Chinese banks, which is a huge positive for Asia.

Despite a probable hike in interest rates in 2022, the low rates in the near term will lead to lower net-income margins. However, this will be compensated for by non-interest income channels like trading and fee-based services. In a global survey of 8 major markets, 88% of the banking executives forecasted improved top-line revenues for banks in 2022.

Heading into 2022, the ratings for the top 200 banks appear stable. Apart from improvement in profitability, asset quality appears good, despite the rise of Non Performing Assets (NPAs) during Covid-19.

Top Dividend Paying Banking Stocks 2022

Here are our top picks for dividend-paying banking stocks in 2022.

1. Bank of America

Bank of America reported Q4 2021 profits in line with investor expectations. Revenues grew by 10% to $ 22.17 billion, close to the estimated $22.2 billion. The fourth-quarter profit increased 28% to reach $7.01 billion. The stock ranks among the top-tier in terms of its weighted relative strength spread over the past year. The bank recently declared a dividend of $0.21, ex-div date March 3, 2022. It will likely declare a quarterly dividend of $0.21 on April 21, 2022, ex-div date of June 2, 2022.

2. Wells Fargo

One of the biggest financial institutions in the US, Wells Fargo ranks higher in terms of its return on invested capital and buyback yield. The bank’s Q4 2021 profit beat analyst expectations. Revenue came in at $20.856 billion, higher than the consensus of $18.824 billion. The bank credits this performance to an increase in consumer spending, higher fee-based services growth in asset and investment banking, and strong equity gains in its private equity businesses.

The bank declared a dividend of $0.25 on January 25, 2022. We forecast a dividend of $0.30 on April 26, 2022, ex-div date May 5, 2022.

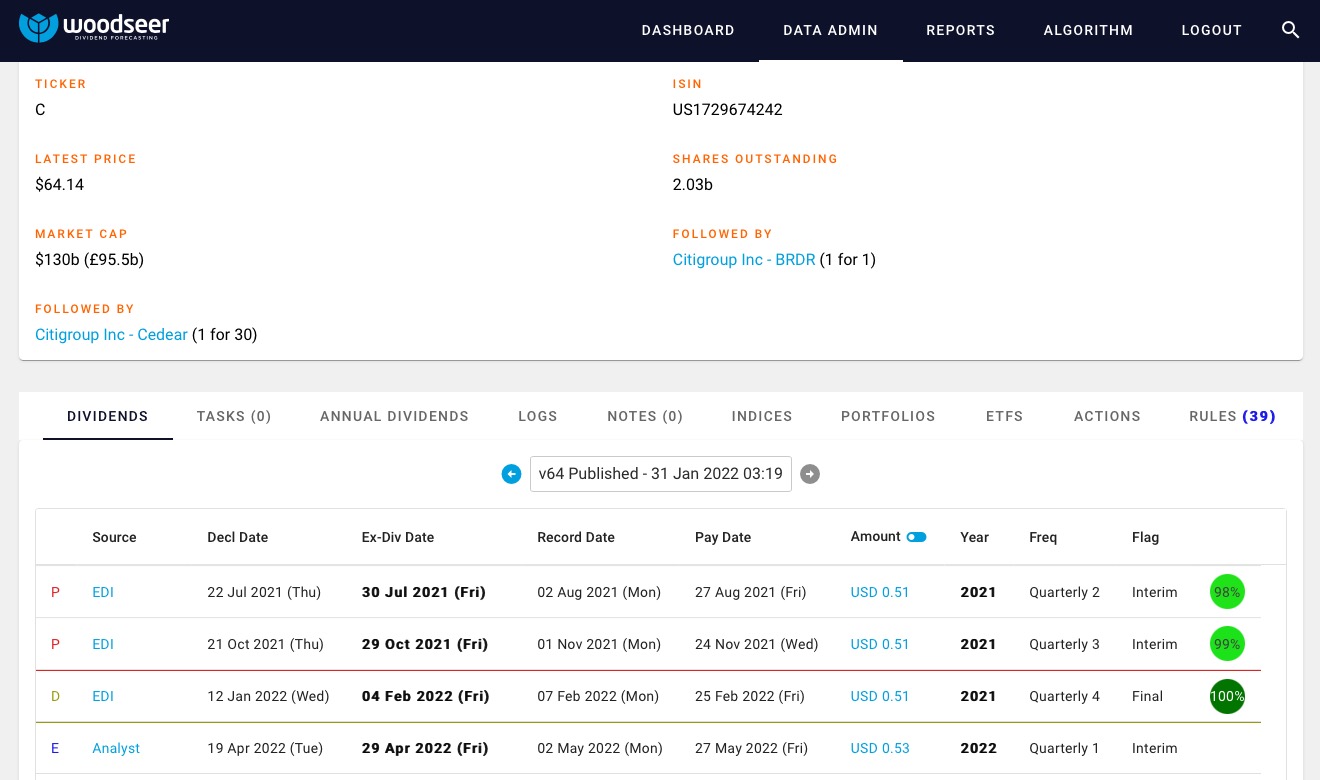

3. Citigroup Inc.

Citigroup reported net income of $3.2 billion for Q4 2021, on revenues of $17 billion. Revenue growth of 1% YoY was driven by strong growth in investment and corporate banking. However, net income showed a decline of 26% YoY due to higher expenses.

The group declared a quarterly dividend of $0.51 on January 12th with ex-div date of February 4. We are forecasting its next quarterly dividend will increase to $0.53 with ex-div date of April 29.

4. JPMorgan Chase & Co. (JPM)

JP Morgan Chase remains one of the largest and most profitable banks globally. For Q4 2021, the bank reported revenue of $29.3 billion. Other significant milestones included a $1.8 billion net credit reserve release, translating to $0.47 increase in EPS. Chase attributed its solid performance to increased capital markets activity, and lending activity which drove average loans up 6%.

The bank distributed a common dividend worth $3 billion in Q4 2021. We expect an increase in its dividend pay-out to $1.10 for the first quarter on March 15, with ex-date April 5.

5. CI Financial Corp (CIX)

Toronto-based CI Financial Corp recorded a stellar Q3 2021, with a new all-time high level for assets and net inflows in 6 years. Quarterly adjusted EPS stood at CAD 0.80, with EBITDA per share of CAD 0.71. The company acquired 2 private US wealth management firms during the year, as part of its business transformation and expansion efforts.

The bank declared a dividend of CAD 0.18 on November 10, 2021, ex-div date March 30, 2022. We estimate a dividend continuing at CAD 0.18, with ex-date June 28.

Getting Dividend Predictions Right with Woodseer

Key risks remain for the global banking sector in the form of new virus variants, high debt levels in corporate and government sectors, property sector doldrums and disorderly reflation. We could also look at a decline in loan asset quality as fiscal and monetary policy support is slowly pulled away.

Woodseer Global equips its clients with accurate dividend forecast data, in every kind of economic environment. With our hybrid AI+analyst approach our dividend estimates are used by the world’s largest bank trading desks, index providers, market makers and hedge funds. We maintain an average 98% annual repeat business rate since 2017. Contact us to learn more.