Celebrity endorsement in the global pharmaceutical industry has always been a controversial subject. On the one hand, celebrity promotion enables millions of people to get awareness of the medication suitable for their existing health needs. On the other hand, celebrity promotion presents a set of regulatory and ethical problems that can cause detrimental harm by replacing professional medical advice with unscientific personal testimonials.

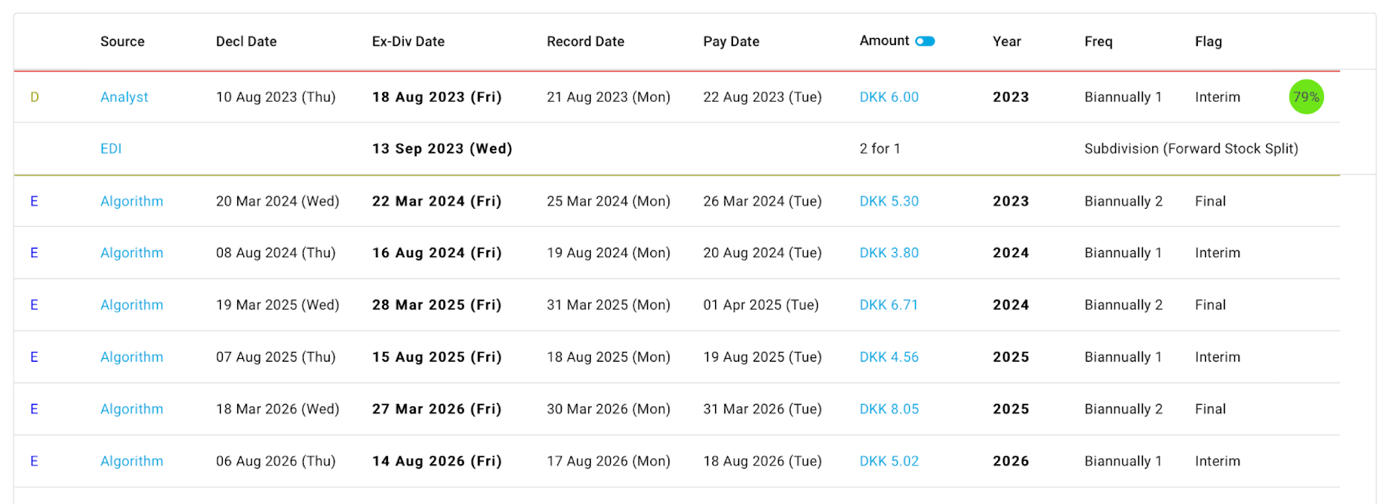

Celebrity endorsement of prescription drugs to the public is currently allowed only in the United States and New Zealand. In the remaining regions of the world, celebrity endorsement of prescription-only pharmaceutical medications is illegal; yet, social media found a way to overcome this barrier. Celebrity promotion of Novo Nordisk’s top diabetes medication illustrates how celebrities contribute to financial well being of pharmaceutical companies but also signal the beginning of the new pharmaceutical endorsement era whose rules are yet to be established. Rapid sales and revenue growth boosted by celebrities’ involvement in Novo Nordisk’s marketing in the last two years coincides with its interim dividend growth which has increased by 42% since 2021.

Ozempic and Global Pharmaceutical Influencer Marketing

Novo Nordisk’s leading drug Ozempic (semaglutide) is forecast to demonstrate a sales growth of 23% in 2023. Ozempic (or Wegovy with a slightly different amount of semaglutide in each pen) is a recombinant peptide indicated to reduce the risk of major cardiovascular events such as strokes, heart attacks, or mortality among adults with type 2 diabetes and established heart disease. Until 2021, the drug (a branded semaglutide injection) was only prescribed to people with diabetes. However, this all changed when the Food and Drug Administration approved semaglutide (under the brand name Wegovy) as a treatment for chronic obesity.

Because of active promotion of this product by such celebrity patients as Elon Musk and Amy Schumer, Wegovy global distribution already faced manufacturing problems and a struggle to keep up with overwhelming U.S. demand. This resulted in a slower-than-expected roll out of Wegovy in Europe with Germany being the third country to receive Wegovy supply in July 2023 following Norway and Denmark. Wegovy aims to launch in the UK in 2023, although there is no news of the Wegovy UK release date yet. Nevertheless, Novo Nordisk’s latest financial report proves that the success of Ozempic seems to be explosive and game-changing in the foreseeable future for millions of patients suffering from major cardiovascular events globally. Unlike previous type-2 diabetes and weight-loss medications, Ozempic and Wegovy’s current thriving and forecasted stable growth has been mostly influenced by two events: accreditation resulted from trustworthy clinical trials worldwide and an increased demand due to successful celebrity endorsement. Ozempic and Wegovy demonstrate strong sales growth forecasts globally up until 2029 supported by ever growing global demand. Additionally, minimal side effects specifically distinguished Ozempic in the market and accelerated its approval in the most profitable markets of the world: US. UK, and EU.

Novo Nordisk Current Approval Status in the US, UK, and EU and Why it Matters

The official sales forecast for Ozempic for the next five years demonstrates that slightly more than 60% of annual sales is expected to occur in the United States, while the European Union with the United Kingdom are expected to bring 20% of sales, and the rest of the world contribute to the remaining 20%. Because the bulk of the sales are expected to come from the U.S., U.K., and E.U., it is significant to highlight the differences in the drug approval and regulation procedures. In some countries, approval can be withdrawn after the postmarket safety monitoring which will inevitably affect sales and reputation of the drug in the global market. Some of the top five reasons for recalls across the world are manufacturing defects, contamination of pharmaceutical ingredients, packaging defects, or mislabelling.

In the United States, pharmaceutical approval is conducted by the Food and Drug Administration (FDA or US FDA). Novo Nordisk received FDA Approval of Ozempic Injection for treatment of type 2 diabetes in December of 2017, and approval for Wegovy was finalized for adults with obesity in June 2021. Both Ozempic and Wegovy adhered to the standard five-steps FDA approval procedure. During the first stage, research for a new drug begins in the laboratory. It is then followed by the preclinical research – drugs undergo laboratory and animal testing to answer basic questions about safety. Step three consists of preclinical trials when drugs are tested on people to make sure they are safe and effective The fourth stage of FDA approval involves a thorough drug review – FDA review teams examine all of the submitted data related to the drug or device and make a decision to approve or not to approve it. Finally, FDA conducts post-market safety monitoring to ensure that all drugs and devices meet safety requirements once products are available for use by the public. It is during the post-market monitoring stage, when approximately 1,400 drugs per year are being recalled, according to FDA statistics. The top three recall reasons include incorrect labeling, defective products, and incorrect potency.

Similarly to the United States, before any new medicine can be used to treat people in the UK, it goes through a strictly monitored development process. Before a clinical trial of a new medicine can begin, a government agency called the Medicines and Healthcare products Regulatory Agency (MHRA) needs to review and authorize it. In the UK, licenses are granted by the Medicines and Healthcare products Regulatory Agency (MHRA) and the European Medicines Agency (EMA). The MHRA Ozempic authorization took place in January 2019. Ozempic has not received approval from the MHRA for use as a weight loss treatment, but it is currently being used off-label in the UK. Additionally, the Health Research Authority (HRA) works to protect and promote the interests of patients and the public in health research. It’s responsible for research ethics committees up and down the country. All medical research involving people in the UK, whether in the NHS or the private sector, first has to be approved by an independent research ethics committee. After passing the clinical trials, a license will be granted before it can be made available for wider use. Since licenses are only granted if strict safety and quality standards are met, Ozempic currently occupies a safe niche in the market. However, the possibility for a recall still exists. Unlike the United States, some recalls in the UK do not necessarily physically withdraw drugs from the market. Instead, MHRA applies defect risk classification. There are four classes of medicines’ recalls and only the first class of recalls requires immediate actions on the part of MHRA.

The European Union requires all medicines to be authorized before they can be marketed and made available to patients. There are two main routes for authorizing medicines: a centralized route and a national route. Under the centralized authorisation procedure, pharmaceutical companies submit a single marketing-authorisation application to EMA.This allows the marketing-authorisation holder to market the medicine and make it available to patients and healthcare professionals throughout the EU on the basis of a single marketing authorisation. EMA’s Committee for Medicinal products for Human Use (CHMP) or Committee for Medicinal products for Veterinary Use (CVMP) carry out a scientific assessment of the application and give a recommendation on whether the medicine should be marketed or not. The European Commission granted a marketing authorisation valid throughout the European Union for Ozempic on 8 February 2018 and semaglutide (Ozempic) 2.4 mg received EMA approval for obesity in 2021. The latest EMA involvement in Ozempic’s monitoring is its decision to authorize the Pharmacovigilance Risk Assessment Committee (PRAC) of the European Medicines Agency (EMA) to investigate the data on the risk of suicidal and self-harming thoughts linked to the use of Ozempic, Saxenda (liraglutide) and Wegovy (semaglutide) in July 2023. Both the EMA and FDA classify recalls into three categories. Most recalled medicines and products are found in class 2. Drug recalls occur before any injuries have been caused due to the potential safety concerns noted by the manufacturer. Therefore, PRAC involvement in Ozempic safety investigation at this stage is within normal standards of EMA safety monitoring.

Is Ozempic (Wegovy) a Dominant Type-2 diabetes Weight-Loss Market Leader?

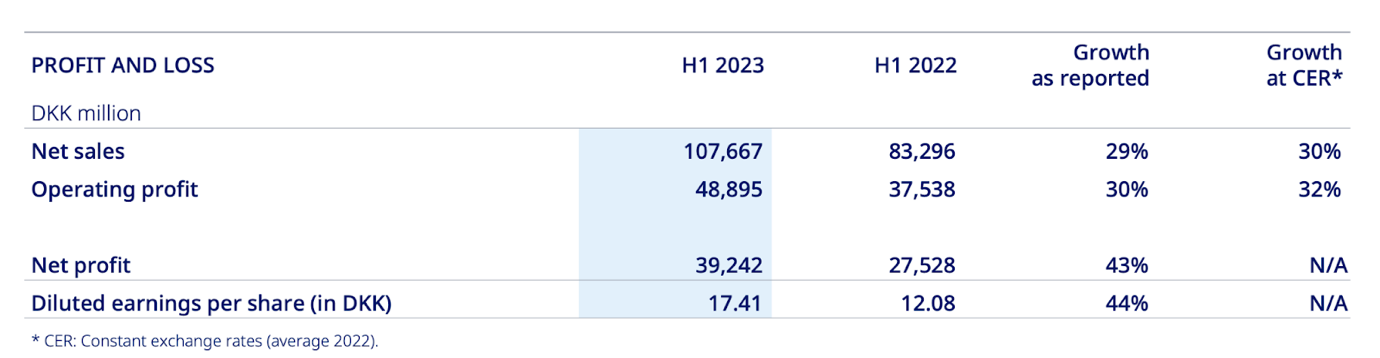

In 2023, Novo Nordisk’s leading drug Ozempic (semaglutide) projected sales will be 54% greater than closest competitor Trulicity (dulaglutide) by Eli Lilly, which anticipates sales of $8 billion.Trulicity is also used together with diet and exercise to improve blood sugar control in adults with type 2 diabetes mellitus to reduce the chances of cardiovascular events. Novo Nordisk had revenues for the full year 2022 25.68% above the prior year’s results. In the latest financial report, sales in North America Operations increased by 45% in DKK (44% at CER), while sales in International Operations increased by 14% in DKK (17% at CER). The report also indicated that operating expenses, such as cost of goods sold, distribution, research and development, and administrative costs also increased in the range from 9% to 34% depending on the cost category. Novo Nordisk diluted earnings per share (in DKK) has increased from 12.08 to 17.41 which represents a 44% growth. Interim dividend for 2023 was announced to be 6.00 DKK for each Novo Nordisk A and B share of DKK 0.20 compared to 4.25 DKK in 2022 and 3.50 in 2021. Net sales increased by 29%, operating profit by 30%, and net profit by 43% compared to 2022 results.

Image Courtesy of Woodseer Global https://app.woodseer.global/admin/securities/72187

However, some doctors anticipate that the most powerful weight-loss medication is yet to come to the global pharmaceutical arena. As of May 2022, Eli Lilly’s drug tirzepatide (brand name: Mounjaro) is FDA-approved for use in patients with type-2 diabetes mellitus and not for weight loss alone. Mounjaro’s active ingredient tirzepatide leads to more clinically significant weight loss and blood sugar reductions than semaglutide (the active ingredient in Ozempic). Mounjaro received a marketing authorisation valid throughout the EU on 15 September 2022. Mounjaro is not currently available to buy in the UK because NICE UK (National Institute for Health and Care Excellence) announced that it would need more evidence before being able to recommend tirzepatide for the treatment of type 2 diabetes in June of 2023. Mounjaro’s approval for weight-loss is expected to come as soon as late 2023. So far, it’s approved only for people with diabetes, not for people who are overweight or obese. Just like Ozempic and Wegovy, Mounjaro requires continuous taking of the medication to keep the weight off. Nevertheless, Ozempic is still proved to lead to fewer side effects than Mounjaro, so the risk for the competition until weight-loss approval is granted is not concerning.

Effectiveness of Current Marketing – Unpaid Celebrity Endorsement Phenomenon

Unpaid celebrity endorsement is one of the distinguishing characteristics of Ozempic and Wegovy that contributed to its worldwide popularity and steep net sales growth in the last two years. Effectiveness of unpaid endorsement by such celebrities as Elon Musk illustrates the emergence of the so-called social media celebrity patient influencers phenomenon to combat conventional direct-to-consumer pharmaceutical marketing which has gained negative public perceptions in the last two decades. American social media influencers dominate the global market with the range of 60% to 80% of the most followed accounts worldwide in different social media platforms. The vastness of global demographic reach and emotional linkage with followers is an extremely appealing marketing channel for pharmaceutical companies. Additionally, when celebrities promote products on social media, it can be almost impossible to tell if the endorsement is paid. This creates a paradoxical trust between the influencer and its audience because potential patients interpret the absence of admitted pharmaceutical sponsorship as a genuine attempt to help consumers feel better and are more likely to buy the product.

Effectiveness of Current Marketing – Global Reach Supported by Reputable Clinical Trials

In many regions of the world, celebrity endorsement of prescription-only pharmaceutical medications is illegal. For instance, in the UK, endorsements by celebrities could be viewed by the public as giving undue appeal to one product over another or as an exploitation of the credulity of the audience. Moreover, even public testimonials cannot contain any direct or indirect promotion by celebrities, scientists, or healthcare professionals. In the EU, drug companies are not allowed to publicly promote prescription-only medicines but advertising for other medicines under certain conditions is allowed. The promotion of prescription drugs to the public is currently allowed only in the United States and New Zealand.

Yet, social media transgresses international pharma regulations since anyone in the world can create an account on any Meta platform and come across unsponsored celebrities praising Ozempic’s or Wegovy’s effectiveness and safety. Although this type of marketing is frustrating to health care professionals, some researchers argue that it does not violate regulations because celebrities self-select to engage in pharmaceutical marketing efforts and their testimonials stay within the boundaries of disease awareness—the type of advertising mostly permitted by regulating government agencies globally. Additionally, since 42 % of American consumers do not trust in the pharmaceutical industry while eMarketer also confirmed that consumer response is highest when messages are delivered from social media influencers compared to brand-owned channels, the interest in exploring celebrity endorsement in the global pharmaceutical industry is expected to grow.

Global reach of Ozempic caused by celebrity endorsement is also supported by reputable trials which further increases desirability of the product. Five studies in over 4,000 patients showed that Ozempic lowered levels of HbA1c (a measure of blood glucose) by between 1.2 and 1.8 percentage points over 10 to 13 months. A further study in over 3,000 diabetes patients at high risk of heart problems showed that fewer patients taking Ozempic had a heart attack or stroke. Moreover, Ozempic reduced the incidence of adverse cardiac events by about 26% relative to placebo[1]. Additionally, Ozempic was found to lower A1C (HbA1C or hemoglobin) more than its main current competitor, Trulicity. Ozempic’ stomach side effects are also found to be less severe compared to its major future competitor, Mounjaro.

Issues of Celebrity Endorsement – Global Regulation Issue

Unpaid promotion of any pharmaceutical drug via social media by celebrity influencers who have no official qualifications as dietitians or nutritionists also presents a regulation dilemma. Global pharmaceutical researchers from Canada and the United States admit the lack of research in this area and label celebrity patients as a new covert marketing tactic to avoid navigating complex Food and Drug Administration (FDA) and Federal Trade Commission (FTC) regulations, concerns about authenticity, and managing consumer engagement. Although celebrity endorsement has always been a controversial subject, previous regulations related to prescription-only pharmaceutical medications prior to social media were straightforward—both pharmaceutical companies and celebrities bore legal responsibility in case the product was misleading and unsafe. For instance, the former Playboy supermodel and reality TV star, Anna Nicole Smith, became a spokeswoman for TrimSpa (dietary supplement designed for weight loss) in October 2003, after losing a reported 60 to 70 pounds. As a result of Smith’s endorsement, during the first year, TrimSpa sales ballooned 172% to $43 million in 2004 from close to $16 million in the year earlier. But by 2006, sales had shrunk to $19.5 million. The decline in sales was due to the class-action against both Smith and TrimSpa alleging their marketing of a weight-loss pill was false and misleading The U.S. Federal Trade Commission announced that the marketers of TrimSpa had agreed to pay a settlement of $1.5 million in response to an FTC complaint of hiding that TrimSpa does not contain the component p57 from Hoodia that is responsible for the appetite suppressant ability. In September 2008, TrimSpa legal case was turned into Chapter 7 liquidation. The case of TrimSpa illustrates that even though the United States and New Zealand are the only safe havens for celebrity endorsement in the world, many celebrities can’t afford engaging in misleading pharmaceutical marketing for the reasons of potential personal liability. Although the same conditions for sponsored pharmaceutical endorsement still apply today, no known academic research is published on unpaid pharmaceutical influencer marketing and its universal regulation rules today.

Issues of Celebrity Endorsement – Novo Nordisk Global Supply Shortage

Novo Nordisk’s booming net sales and net profit growth also presents a set of ethical issues associated with celebrities assisting in its world-wide promotion: global medication shortage and social media regulation dilemma. Novo Nordisk’s effectiveness and safety has gained special attention from Hollywood celebrities like Elon Musk and Amy Schumer. Both celebrities denied Novo Nordisk’ sponsorship; yet their visible weight-loss results and confirmation of using Wegovy provoked a “Hollywood craze” with the following global shortage of Ozempic worldwide. In the case of Novo Nordisk’s leading drug, the official sales forecast for Ozempic for the next five years demonstrates even greater global demand- more than 60% of annual sales is expected to occur in the United States, while Europe and the rest of the world contribute to the remaining 40%. Disproportionate geographical sales expectations for the U.S. compared to the rest of the world are not only linked to an increased demand to combat type-2 diabetes and obesity. According to research conducted by Forbes in 2021, the U.S. patients do not buy or use more drugs than the rest of the world, but they do pay more for what they use. This is in line with its spending on healthcare overall, which is far greater than in similar countries where drug consumption is on par with the United States.

As a result, the amount of customers interested in the effective and safe weight-loss drug in the United States outnumbered patients with type-2 diabetes globally. This led to the worldwide shortage of semaglutide that started to affect Australia in early 2022 when Novo Nordisk couldn’t supply enough Ozempic to meet an unexpected increase in demand due to off-label prescribing for weight loss. Novo Nordisk is likely to be impacted by intermittent supply shortage running into 2025. It is still unclear how Novo Nordisk aims to improve Ozempic’s global shortage, but it already hired Thermo Fisher as its contract manufacturer to complete injection pen fillings for Wegovy. Even though unpaid endorsement by Hollywood celebrities contributed to the tremendous sales increase in the last two years, it also highlighted an emerging ethical issue of unequal distribution of the drug worldwide, where people with type-2 diabetes were not able to get their medication and had to reassess their treatment urgently.

Future of Novo Nordisk and Celebrities in Pharmaceutical Global Marketing

Celebrity endorsement made Novo Nordisk especially noticeable among its immediate competitors in the global diabetes and weight-loss market in the last two years. The future of celebrities in pharmaceutical global marketing remains ever changing. Novo Nordisk demonstrates how celebrities’ contribution was both effective in global promotion and problematic for public health agencies. Novo Nordisk’s latest financial report confirmed that the company continues to grow in sales and global reach. Increased sales, revenues, and interim dividends results from the previous year as well as recent hirings of contract manufacturers highlight Novo Nordisk’s ability to combat its problem of global supply shortage. Even though there are still evolving competitors on the market and unraveling ethical dilemmas surrounding celebrities as promoters of Ozempic and Wegovy, Novo’ sales growth in the foreseeable future is strong.

Written and researched by Rushana Galeeva