By Samuel Olavarría

Dividend Analyst at Woodseer Global

After a prolonged period of unconventional monetary policy, the Bank of Japan (BoJ) has embarked on a significant shift, moving away from negative interest rates—a decision that marks the end of the world’s last negative interest rate policy. This pivotal change is expected to have wide-ranging effects on the Japanese economy, influencing everything from consumer behavior to corporate finance strategies, in particular how companies approach dividend payouts.

Since 2016, Japan has maintained negative interest rates as part of its aggressive monetary easing strategy aimed at combating deflation and stimulating economic growth. By penalizing banks for holding excess reserves, the BoJ hoped to encourage lending and investment. However, the effectiveness of this policy has been mixed, with significant implications for savings and investment patterns within the economy.

Over the past decade, Japanese companies have increasingly adopted shareholder-friendly practices, leading to a steady rise in dividend payouts. This shift was supported by government initiatives aimed at improving corporate governance and capital efficiency. As a result, dividend distributions on the Tokyo Stock Exchange reached record highs almost every year, makingdividend-paying stocks highly attractive in an environment of ultra-low interest rates.

Dividend theory suggests several key reasons why companies choose to pay dividends, including signaling confidence to the market and meeting investor expectations for income. Traditionally, dividend policies are influenced by factors like taxconsiderations, market conditions, and internal financing needs. Interest rates play a critical role in these decisions by affecting the cost of capital. Higher interest rates increase the cost of borrowing, making debt financing more expensive and potentially leading firms to retain more earnings for internal funding needs rather than distributing them as dividends.

As Japan transitions away from negative rates, the immediate consequence is an expected rise in borrowing costs. This shiftcould lead companies to reevaluate their balance sheets and prioritize financial stability over returning cash to shareholders,especially in sectors where capital needs are significant, such as manufacturing and infrastructure. Conversely, for industries less reliant on debt, such as technology and services, the impact may be less pronounced, allowing them to maintain or even increase dividend distributions.

During the era of negative interest rates, Japanese stocks with high dividend yields became particularly attractive to local investors, as traditional savings offered little to no returns. Data from Nikkei Asia indicates that sectors like financial services and utilities have seen robust interest due to their high dividend yields, suggesting that these stocks may continue to attractinvestor attention in the short term despite rising rates.

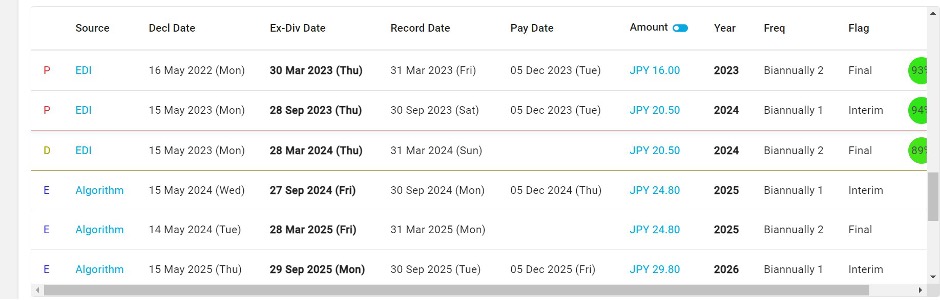

Financial institutions, traditionally major dividend payers, might face an adjustment period. Higher interest rates can benefitbanks’ net interest margins by increasing the spread between what banks earn on loans and pay on deposits. However, this might also mean higher costs for capital, prompting a cautious approach to dividend increases. Woodseer dividend dataset shows companies like Mitsubishi UFJ

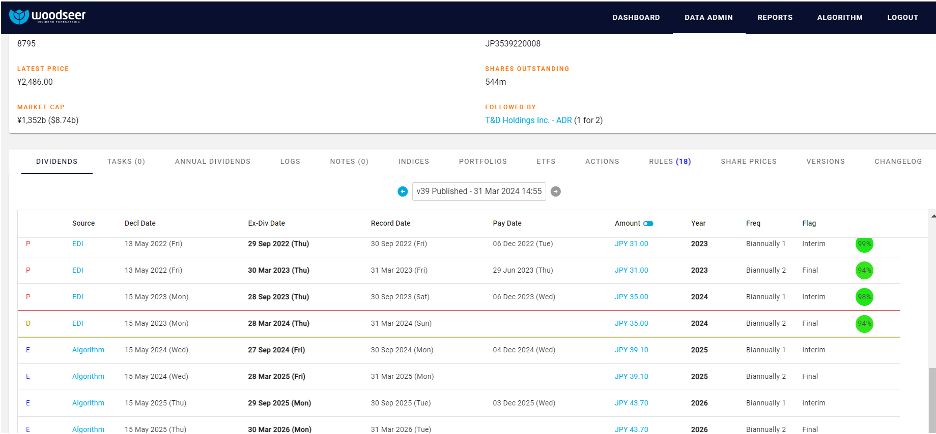

Financial Group and insurance group T&D Holdings have already signaled potential dividend hikes, reflecting confidence in managing these new conditions.

Source: OptionMetrics’ Woodseer Dataset – Data above is for MUFG (Mitsubishi UFJ Financial Group)

Source: OptionMetrics’ Woodseer DataSet – Data for T&D Holdings

The policy shift is also significant for international investors, who must now factor in the potential appreciation of the Japanese Yen. A stronger Yen could diminish the relative value of dividends when converted to other currencies, affecting the total returnon investment for foreign shareholders. This dynamic is critical given the substantial role international investors play in the Japanese stock market, as noted in a Bloomberg report.

Over the longer term, the shift away from negative interest rates could encourage Japanese companies to adopt moreconservative financial strategies. With the cost of capital likely to rise, firms might prioritize efficiency improvements and debt reduction over aggressive expansion or generous dividend policies.

This could lead to a more sustainable, albeit slower, growth trajectory for dividends, aligning Japan more closely with global dividend practices.

However, current dividend trends from Japan contradict this notion. While the cost of capital is increasing, the BOJ’s interest hike has improved investor sentiment in the region, signaling to firm’s that this shift in policy will result in prudent financialmanagement. Thus, firms have already begun increasing their dividend payouts. Woodseer data, from OptionMetrics, is forecasting that companies will look to increase their dividends in the coming year as interest rates could keep increasing.

The Bank of Japan’s decision to end negative interest rates is a turning point for the Japanese economy and its companies.While the immediate impact on dividend policies may vary by sector, the overall trend could lean towards more prudent financial management. Companies are likely to reassess their strategies in light of higher borrowing costs and the changing preferences of both domestic and international investors.

As Japan navigates this new economic landscape, monitoring how companies adjust their dividend policies will provide criticalinsights into the broader implications of the BoJ’s policy shift. Investors will need to stay attuned to these developments, as thetransition could redefine the attractiveness of Japanese equities in a global investment context. Utilizing resources like the Woodseer Dividend Dataset and Forecasting tool will be essential in tracking and predicting these changes, particularly as interest rates potentially continue to rise.

Author: Samuel Olavarría

Samuel Olavarría is pursuing a B.A. in Economics with a minor in Data Science at the University of California, Berkeley, graduating in May 2025. He has gained significant experience through internships, including a role as a Dividend Analyst at Woodseer Global.