Since 2020, supply chain risks and shortfalls have been one of the prime topics in company boardrooms and government policymaking. Around 94% of Fortune 1000 companies have experienced supply chain challenges, and 55% of companies have planned to downgrade their growth outlooks as a result. China’s continued zero-Covid policy and its latest lockdowns, due to surging infections, have impacted the technology industry. For instance, on March 16, 2022, Apple supplier Foxconn forecasted a 3% fall in revenue in 2022, as component costs rose and supply chain woes increase in China.

The Russia/Ukraine war is the latest blow to the global supply chain. Russia’s invasion and the resultant sanctions on it by the West will exacerbate existing challenges, as will global inflation. Rising costs, due to oil price hikes and constraints on the Russian transportation system, will hurt many companies that build products in China and use Russia’s railway network to transport items to eastern and western Europe.

Multi-country disruptions due to Covid-19 and the Ukraine crisis are expected to prolong the supply chain crisis till 2023. How will this impact the dividend policies of companies?

Which Companies Will Lose?

The situation is especially challenging for companies that have complex supply chains. Their productions are disrupted due to input shortages from suppliers. Some sectors likely to be gravely impacted include manufacturing, construction, retail and wholesale trade, and food services. Notable impacts could be seen in automobile and technology companies as well.

In a 2020 KPMG survey on the global manufacturing sector, supply chain risks were identified as the top 3 threats to companies’ growth till 2023. Over 66% of CEOs of manufacturing companies revealed that they had to rethink their approach to supply chains to maintain continuity. The construction sector also continues to face a shortage of raw materials. For instance, in the US, a survey revealed that 90% of builders were facing shortages of appliances, OSB and framing lumber.

The US and Eurozone appear to be in the thick of this crisis. Disruptions are widespread, but companies in the US and Eurozone are the most exposed to these problems, as revealed by the Statista Supply Chain index.

Dividend Predictions for Companies in These Sectors

Let’s look at what’s in store for dividend seekers when it comes to some of the top companies in these sectors.

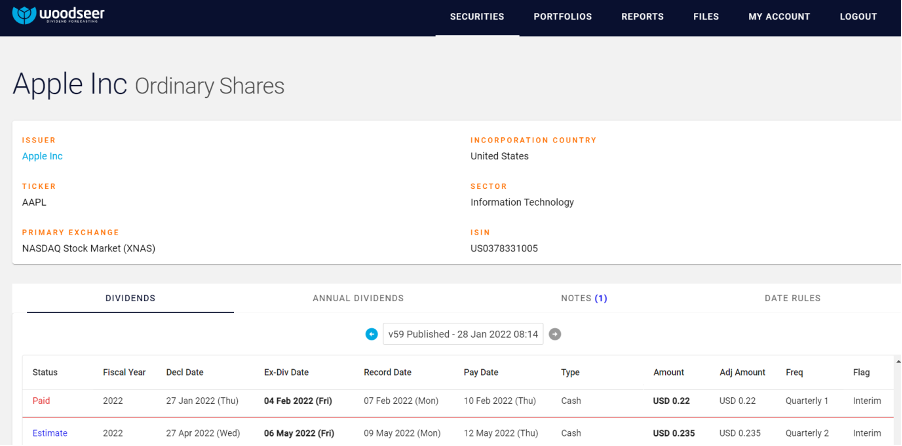

Apple Inc.

The supply chain crisis remains a thorn in Apple’s enormous growth trajectory. However, despite losing $6 billion in revenue due to supply chain problems in Q3 2021, the company pulled in over $124 billion for the quarter. The company seems immune to these disruptions as of now. The recent lockdowns in China are expected to have a limited impact on Apple. This is because its main production site at Foxconn, in Zhengzhou, is considerably less impacted. Apple is expected to pay a quarterly dividend of $0.235 (an increase from the last quarter), ex-div date May 6, 2022.

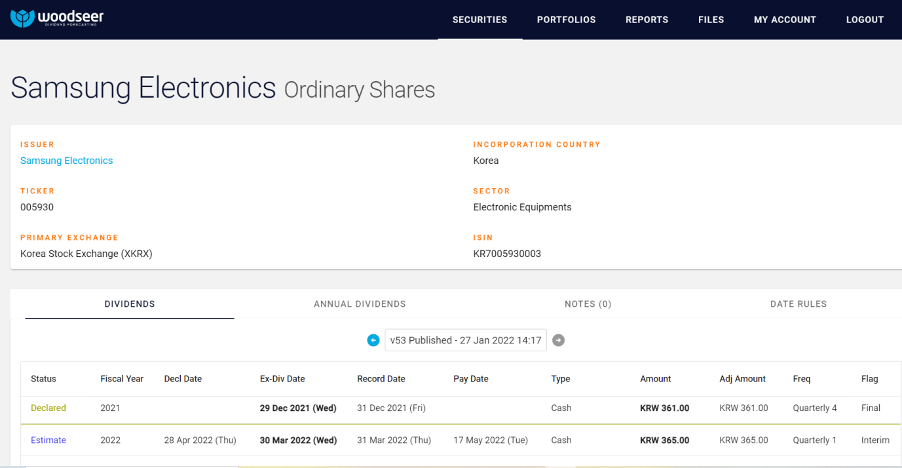

Samsung Electronics

In January 2022, Samsung Electronics announced that it would aim to capture a larger share of the smartphone market during the year. The company’s operating profit increased to its highest level since 2017 in Q4 2021, at 53%. However, the company also warned that supply chain issues will remain a challenge, particularly for non-memory chips. This will be problematic in the face of high demand for 5G smartphones and high-performance computers. The company is expected to announce its first dividend for 2022, of KRW 365 (approximately $0.30), ex-div date March 30, 2022.

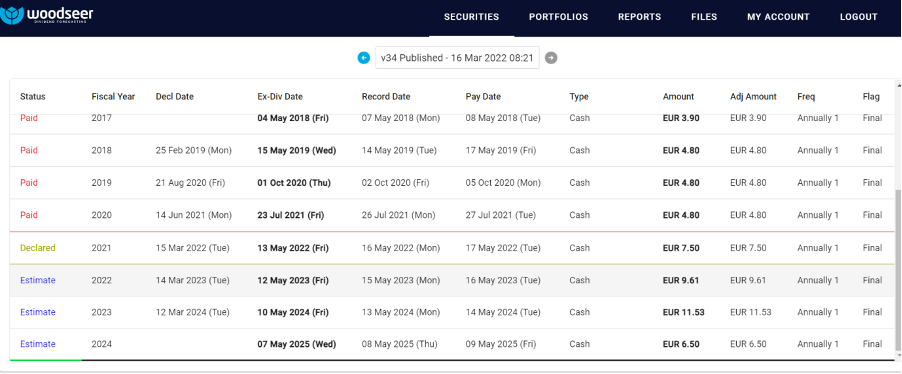

Volkswagen AG

The Ukraine crisis has impacted the automobile giant, as it had to close 2 of its factories in Dresden and Zwickau in February 2022. Chip shortages hounded the company in 2021 as well, forcing it to halt its EV production. Further disruptions cannot be ruled out as tensions between Russia and Ukraine escalate. The company paid a dividend in mid-March 2022 and is not expected to pay a dividend before March 2023. It is expected to pay €9.61 (approximately $11), ex-div date May 12, 2023.

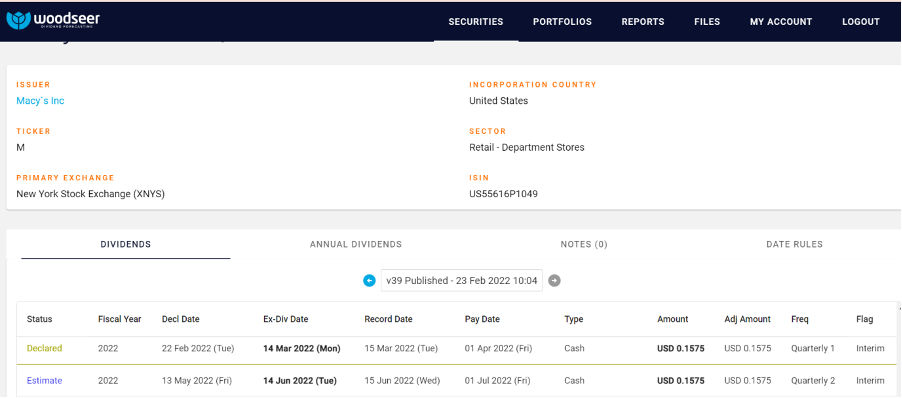

Some Notable Exceptions

Despite all odds, some US retailers, like Macy’s, Best Buy and Home Depot, kept up consistent and sometimes higher dividends in 2021 and 2022. Macy’s, for instance, suspended dividends in 2020 but declared an increased dividend for Q1 2022 of $0.1575, ex-div date March 14, 2022. The company is expected to pay out $0.1575, ex-div date June 14, 2022.

Which Companies Will Win?

Sectors like energy, logistics and shipping are benefitting from the escalating costs. Supply crunch fears will keep oil prices on the higher side and volatile until 2023. The cost of shipping passages between Asia, the US and Europe have increased 8 fold, compared to the 2019 prices. Higher demand for door-to-door deliveries, logistical problems due to closed Chinese harbours and surging outbreaks will keep prices high.

Dividend Predictions for Companies in These Sectors

AP Moller-Maersk

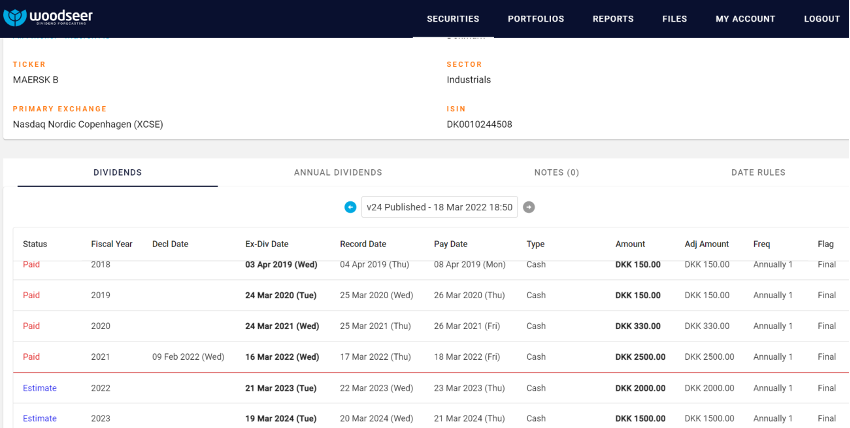

In 2021, AP Moller-Maersk saw 41% growth in revenues, $9.8 billion. The dividend yield stood at 10.7%, an increase compared from the 2.4% in 2020. The payment of dividends worth DKK 2,500 (approximately $370) took place on March 18, 2022. The company is expected to pay a reduced dividend of DKK 2,000 (approximately $296), ex-div date March 21, 2023.

Cosco Shipping Development Co. Ltd

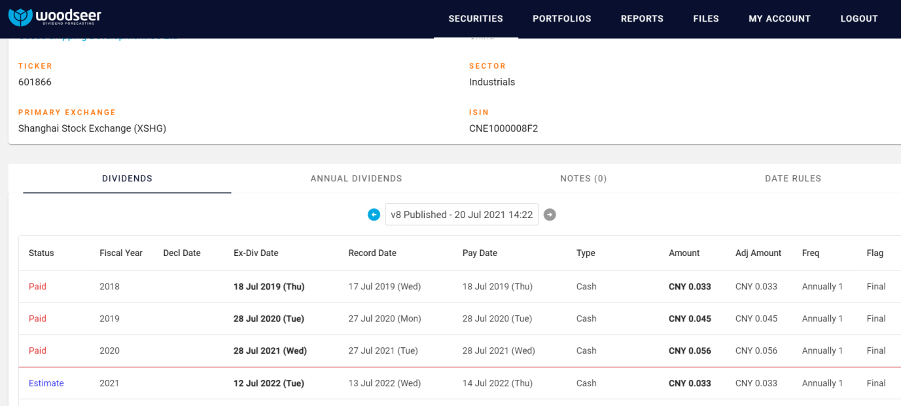

Cosco Shipping Holdings had registered a massive 1,651% increase in revenues in the first 9 months of 2021. It announced a 261% surge in earnings in FY 2021, compared to the previous year, at $21 million. Cosco Shipping Development Company is expected to pay out a dividend of CNY 0.033 (approxiamtely $0.005), ex-div date July 12, 2022.

Canadian Natural Resources

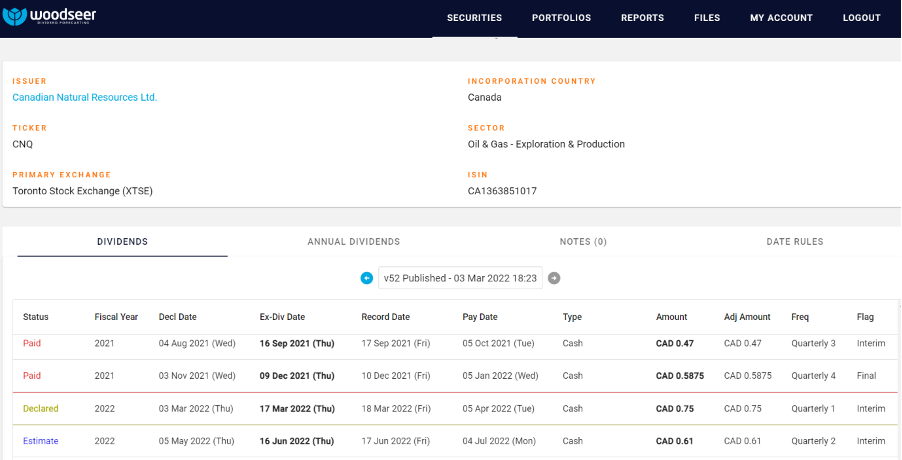

Canadian Natural Resources raised its dividend twice in 2021, representing a 38% combined increase. The total return to shareholders stood at $3.8 billion in 2021, of which 58% was through dividend payments. The company declared an increased dividend of CAD 0.75 (approximately $0.60), ex-div date March 17, 2022. It is expected to pay a lower dividend of CAD 0.61 (approximately 0.50), ex-div date June 16, 2022.

Forecasting Dividends the Woodseer Way

Geopolitical developments, Covid-19 and changing consumer behaviour will continue to shift supply chain trends. Technology, talent, location and costs are some factors that will continue to make this sector an ever-evolving one. Several companies will be knocked off-balance, but many will show resilience.

Woodseer’s analyst+AI methodology can help investment managers receive accurate dividend forecasts amidst this complicated landscape. We offer accurate, reliable and real-time dividend forecasts for the global markets, with the highest success rate in the industry on previous API comparison trials. Contact us to learn more.